In January, Canada’s Inflation Rate dropped to 2.9%, Enhancing the Likelihood of Interest Rate Reductions.

In January, the year-over-year increase in the Consumer Price Index (CPI) was recorded at 2.9%, a notable decrease from the 3.4% rate observed in December. A significant factor in this slowdown was the 4% year-over-year drop in gasoline prices, a stark contrast to the 1.4% increase seen in the previous month. When gasoline is excluded, the overall CPI increase moderated to 3.2% from December’s 3.5%.

This headline inflation rate of 2.9% signifies the first occasion since June that inflation has aligned with the Bank of Canada’s target range of 1% to 3%, and it’s only the second instance of falling within this range since March 2021.

Additionally, the inflation rate for groceries saw a widespread slowdown to 3.4% year-over-year in January, down from December’s 4.7%. Contributing to this overall deceleration were lower prices for airfares and travel tours, along with a 1.3% year-over-year decrease in clothing and footwear prices, likely influenced by the discounting of winter apparel following a milder winter across much of the country.

The housing sector remains the most significant driver of yearly inflation. The delayed impact of previous central bank rate increases is reflected in the CPI. The year-over-year increase in mortgage interest costs slightly decreased in January but still surged by 27.4%, accounting for about a quarter of the total annual inflation. Excluding mortgage costs, inflation now stands at 2.0%. Although home rent prices are rising, the shelter category saw a minor decrease in homeowners’ replacement costs due to slower growth in house prices.

Every month, the CPI remained stable in January, following a 0.3% decrease in December. Adjusted for seasonal variations, the CPI experienced a 0.1% decline in January, marking the first decrease since May 2020.

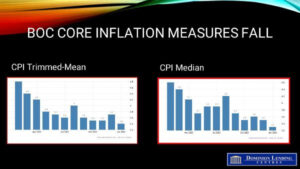

The Bank of Canada utilizes core inflation measures, such as the trim and median core rates, which exclude volatile price fluctuations to gauge underlying inflation levels. The CPI trim decreased by three points to 3.4%, while the median declined by two points to 3.3% compared to the previous year, as depicted in the chart below.

Significantly, the proportion of goods and services in the CPI basket experiencing growth of over 5% has decreased from its peak of 68% in May 2022 to 28% in January 2024.

The Bank of Canada Governing Council’s upcoming meeting is scheduled for March 6. Although January’s inflation report exceeded expectations and indicates a narrowing scope of inflation, it remains significantly above the target level of 2%.

Shelter inflation is expected to persist, fueled by the impact of increased mortgage rates from the previous year and exacerbated by the acute housing shortage, leading to elevated rental prices.

Given the ongoing high wage gains and core inflation measures surpassing 3%, the Bank of Canada is likely to maintain a cautious stance. I maintain my prediction that the Bank will commence rate cuts in June.